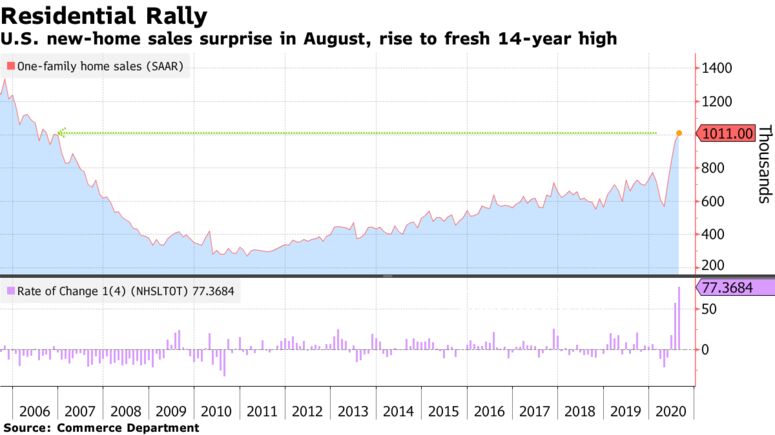

U.S. New-Home Sales Climb to 1 Million Rate, Fastest Since 2006

Sales of new homes in the U.S. unexpectedly advanced for a fourth month in August to the highest level in almost 14 years as record-low mortgage rates continued to entice buyers into a market with ever-shrinking supply.

Purchases of new single-family houses increased 4.8% to a 1 million annualized pace, led by a flurry of demand in the South, after an upwardly revised 14.7% surge in July, government data showed Thursday. The median selling price decreased from a year earlier to $312,800 and the number of homes for sale dropped to an almost three-year low. Economists expected an 890,000 pace, according to the median estimate in a Bloomberg survey.

The data are the latest to highlight momentum in the housing market, driven by low borrowing costs and a desire for new property during a pandemic that’s led to many more Americans to work from home. At the same time, it’s difficult to gauge how long such robust demand will last, given the scale of layoffs and the potential for future job cuts without a federal fiscal aid package.

Sales rose in two of four regions led by the South — the largest region — where purchases surged 13.4% to the highest level since 2005. Demand also increased in the Northeast.

The supply of new homes continued to fall. At the current sales pace, it would take 3.3 months to exhaust the supply, the shortest time frame in records to 1963.

Builder Backlogs

It’s the same picture for backlogs: the number of properties sold for which construction hadn’t yet started jumped to 342,000 in August, also the highest since 2006 and a sign builders will be busy for months to come.

Buyers are opting for new homes as fewer homeowners seek to sell their own properties. Mortgage rates are set to remain at historically low levels amid stimulative Federal Reserve monetary policy aimed at shoring up economic activity.

Other figures corroborate the high demand for real estate. Existing home sales strengthened in August to the highest pace since the end of 2006, following a record jump in July. Homebuilder optimism is also at an all-time high, reflecting strong current sales, the demand outlook and increased prospective buyer foot traffic.

The new-home sales report, released jointly by the Census Bureau and Department of Housing and Urban Development, tends to be volatile: it showed 90% confidence that the change in sales last month ranged from a 5.7% decline to a 15.3% increase.